The Brooklyn Daily Eagle from Brooklyn, New York • Page 23

- Publication:

- The Brooklyn Daily Eaglei

- Location:

- Brooklyn, New York

- Issue Date:

- Page:

- 23

Extracted Article Text (OCR)

25 THE BROOKLYN DAILY EAGLE, NEW YORK, WEDNESDAY, APRIL 10, 1929. OHRSTROH PLANS The Day's New Investments Brooklyn Capital, Stock Offered at $23 a Share. TALLEST BUILDING CALUMET-ARIZONA ENTERSMERGER Will Unite With New Cornelia Copper Company. officers and board of directors of the company returned here yesterday from Adjo, where they met with the heads of the New Cornelia Company and voted the merger. Under the plan which Mr.

Campbell said would be approved by the stockholders of his company, shareholders will receive one share in the consolidated company for one share of Calumet and Arizona stock. Two and 85-100ths shares of New Cornelia Company stock will draw one share in the new company. To Take Name of Bank of Manhattan Company. A syndicate headed by G. L.

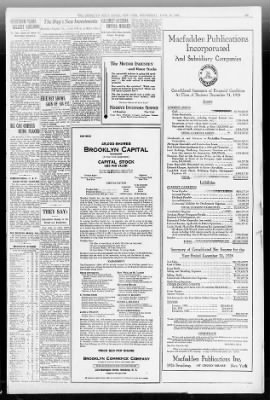

Ohrstrom Se announced that it will erect a 63-story offlce Public offering was made of 45,000 shares of capital stock, $20 par value, of the Brooklyn Capital, priced at $23 per share, by the Brooklyn Commerce Company. The company was recently organized under the laws of New York to buy, sell and hold stocks and securities of bank, trust, Insurance, title and other companies engaged in business In Rrnnklvn and Long Island. Lordsburg, N. April 10 P)-The Calumet Arizona Mining Company be consolidated with the New Cornelia Copper Company, the merged concern to have a capital stock nf $20,500,000. Gordon R.

Campbell, president of the Calumet and Arizona, and the tuildlng, the tallest structure of that Macf adden Publications Incorporated And Subsidiary Companies The Chase National Bank has been appointed registrar for 84.050 shurei preferred par valu and 2U0.00C shares pf common stock S10 par value of the Faneol Motors Company. type in the world, on a plot in the block bounded by Wall, Pine, Nassau and William sts. The building will be known as the Bank or Manhattan Building, Brooklyn Capital, will receiveJ the Bank of Manhattan Company occupying 100,000 square feet of floor space in it lor its main of flee. Rising 840 feet above the street level, the Duiiaing will De 36 feet higher than the Chrysler a net amount of Jl.ouo.ouu casn irom the issue and sale of 50,000 shares of its capital stock after paying all expenses incident to the organization and exclusive of the remaining 50,000 shares. Ten percent of the issue will be taken for Invest-ment by certain of the organiiers and affiliated Interests.

Crown Cork International. Doino wphhpr Se Co. and Hamble- Building, now under construction at LexlnKton ave. and 42d st. Fronting on Wall about 150 feet, the new building will extend from the United States Assay Office to the Bank of America Building.

I or 4 1 GOOD Vv MAGAZINE 1. share and will be entitled to cumulative dividends of $1 per share per annum before payment of any dividends on the Class stock. Oarlock Packing Debentures. White, Weld Se the Marine Trust Company of Buffalo and Sage. Wolcott Js Steele of Rochester offered $3,000,000 of ten year 6 percent convertible debentures of the Oarlock Packing Company priced at 97'i.

The same houses, with the exception that Marine Union Investors, replaces the Marine Trust Company, are offering 100.000 shares of no-par common stock of the same company, priced at $23 per share. Each $1,000 debenture is convertible at any time prior to the date of maturity or redemption into 35 shares of common stock. MacMarr Stores. Merrill, Lynch Se Co. offered 50,000 shares of MacMarr Stores, common stock at $35 per share.

This company operates a chain of 569 grocery stores on the Pacific Coast. Stock Offering Expected. Public offering of capital stock of North American Mining and Smelting Corporation, a $60,000,000 investment corporation in the mining and smelting industry, is expected to be made shortly by a nation-wide syndicate of Investment bankers, according to E. Marshall Young, vice president ot the corporation. To Offer Davison Coke Preferred.

Financing for the Davison Coke Se Iron Company, recently organized under the laws of Pennsylvania, to engage in the manufacture of coke, pig iron, Portland cement and byproducts of coke, will take the form of a new issue of $6,500,000 6 percent participating preferred stock, cumulative non-callable and voting, and offering is planned by a banking syndicate headed by K. W. Todd Se Ino, ton Co. offered an issue of 185,000 It will also extend through to Pine fronting approximately 194 feet chorea nf no riar uiass A BIOCK Ul Crown Cork International Corpora on that thoroughfare. Demolition of present buildings on the plot.

Including the Bank The Motor Industry and Motor Stocks The automobile industry is going full speed ahead 44 increase in production in February 1929 over the same month last year the trade outlook is exceedingly optimistic. How sound is this optimism? Which com panics are in line for prosperity? Which can will capture popular fancy? The wise investor should seek a coldly rea soned analysis of the motor industry. Send for our latest analysis: "77 Motor Industry and Motor Stocks" MooDrs Investors Service tion recently formed acquire am of the principal foreign subsidiaries now owned by the Crown Cork and Seal Company of Baltimore City and the Crown Ccrk and Seal Company. The stock is priced at $16.50 per of the Manhattan Company building, will begin shortly. The bank will move to temporary quarters at 27-29 Pine st.

during construction The new structure is expected to Consolidated Statement of Financial Condition At Close of Business December 31, 1928 Assets be ready for occupancy by May 1, 1930, which will constitute a new record for building construction of such magnitude. ERIE NET SHOWS GAIN OF 184 P.C. The land and building will represent an investment of approximately $20,000,000, according to the bankers, who will head a group which will undertake the public CURRENT ASSETS Hi ptpa nrwi financing. New York $1,703,862.07 65 Broadway Cash Notes Accounts Receivable, The actual construction will be done by Starrett a subsidiary of the Starrett Corporation, Pkubwia Chksie (oeloa Philadelphia Lee Angela San FraacW. London MoodYi InnMeee Seevire, Ltd.

8.7S6.59 includinr Accrued Interest (less which is associated with O. Ohrstrom Co. In the enterprise. BIG CAR ORDERS BEING PLACED reserves for doubtful accounts, etc.) 1,789,624.08 Inventories, at book values, based on cost 698,024.77 Marketable Stocks and Bonds, at Cost ($25,000.00 par value of b6nds pledged as collateral to lease) 1,364,672.00 TOTAL CURRENT ASSETS $5,564,969.51 Investments in and Advances to Macfadden Newspapers Corporation $1,051,929.72 Mortgages Receivable and Construction Loans 201,792.61 The Baltimore Si Ohio Railroad has put out an inquiry for 2,000 of 70tton hopper cars and 1,000 mill gondolas. This makes about 7,500 domestic freight cars under active Inquiry with many additional cars Stockholders of the Erie Railroad, at their annual meeting re-elected directors whose terms were expiring, and heard a report of the railroad's operations during 1928 which showed Increases In practically all profitable Items, and marked decreases In expenses.

The directors whose terms were expiring were Bernard A. Eckhart, Chicago business man and capitalist; Mitchell D. Follansbee, Chicago attorney; Frederick D. Underwood, retired president of the Erie, and William Wrigley Chicago business man and financier. Reciting the results of 1928 the second year's operation under the management of President Bernet, the report showed, as compared with 1927.

an Increase of $2,500,000 In the railroad's operating revenues and a decrease of $5,000,000 In its operating expenses. The Erie's net revenue from railroad operations during the year increased more than 33 percent and its total net railway operating Income showed an Increase of more than 54 percent. Its net income, at the conclusion nt its balance sheet, showed an Increase of more than 184 percent over 1927 and the sum transferred to profit and loss showed an increase of 303 percent over 1927. The Erie's total railway operating revenue in 1928, as disclosed by the report was $124,976,542.56 as against $122,478,354.59 in 1927. Its railway operating expenses for 1P.2R as ftuftlnst tlOO.264..

still pending. Real Estate Sales Instalments L)ue in 1930 and Thereafter. Land, Buildings, Machinery, Equipment, Furniture and Fixtures (less reserves for depreciation, $290,776.56) 301,774.16 1,958,266.02 NEW ISSUK 45,000 SHARES Brooklyn Capital Incorporated (A New York Corporation) CAPITAL STOCK ($20 PAR VALUE) The Southern Pacific will build 300 flat cars in its own shops. The Houston Collieries has ordered 100 mine cars from the Western Oas Construction Company. Premiums Paid on Life Insurance Policy on Life of Bernarr Macfadden in Favor of the Company (cash surrender value, $55,504.68) 260,357.30 The Southern Pacific has with drawn its inquiry for 250 tank cars.

The Chicago North Western has placed 50 passenger express cars with Pullman and the B. O. is 1,994.52 1,026,949.64 Notes Receivable Discounted (see contra) Deferred Charges, Applicable to Future Good-Will, Trade Marks, Publishing Rights, Development understood to have placed an additional order for seven buffet and five dining cars with the Pullman Company. All stock now authorized or issued is of the tame class, and ail sham have identical rights. Expenses, etc 5,000,117.18 Transfer Agent: Guaranty Trust Company New York total Liabilities CURRENT LIABILITIES CAPITALIZATION G96.69 the year previous.

Its total Registrar: Chase National Bank New York To Be Presently Outstanding None None 50,000 shares INTERNATIONAL P. P. PLANS STOCK INCREASE The first annual meeting of the shareholders of the International Paper and Power Company will be held in Boston, on April 24. At this meeting directors will be elected, and it is proposed to authorize 2.000,000 additional shares net railway operating income ior 1928 was $20,047,159.23 as against $12 flfio.700 for 1927: and its net in Authorized None None 100,000 shares come was $10,002,884. for 1928 as Funded Debt Preferred Stock Common Stock, $20 par value.

of the Class common stock of Notes Payable Accounts Payable. Dividends Payable. Accrued Accounts Contractual Liability for Development Expenses. against $3,512,649.94 the year before. For 1928 the Erie management transferred a balance of $8,614,792 to profit and loss as against a sum of $2,133,763 in 1927 an increase of $6,481,029 or a little more than 303 percent.

the company. Although the -directors of the company have no present plans for me issue oi this additional Class $820,577.50 1,347,293.47 309,684.60 110,000.74 52,439.08 $2,639,995.39 $421,977.39 1,158,540.00 51,791.18 common stock, thev think it TOTAL CURRENT LIABILITIES wise that there be a larger amount avatiame for issue. The present common stock cam THEY SAY: Newsdealers' Deposits talization is 5,000,000 shares of 1 1 Purchase Money Mortgages Payable. Reserves tor Contingencies, etc A 1 AT.l. LI.

i nni r.9 Speculative Gossip in the Street and Elsewhere uiscounieu ioics ivcccivauic tscc Class "A common, of which have been issued and over shares are reserved for conversion of preferred stock; 3.000,000 shares of Class common, of which 1,000,000 shares have been Issued, and 3.000,000 shares of Class common, of which 2,500,000 shares have been Issued. Deferred Income, Applicable to Future Operations 1,845,207.45 Capital Stock, Macfadden Publications Inc. (authorized shares of $5.00 each; issued and to be issued 1,598,167 shares including 1,055 shares issuable in exchange for old stock outstanding, less 6,110 shares held in 7,960,285.00 Surplus 1,288,359.73 TOT AT wwpjvwwi' nw ti 79 an rt: M.J IU IDU.tH) Brooklyn Capital, has been organized under the laws of the State of New York for the purpose, among others, of buying, holding and selling stocks and securities of Bank, Trust, Insurance, Title and other companies engaged in business in the Borough of Brooklyn and throughout Long Island, but its charter does not limit it to such securities. In view of the character of the proposed business, Brooklyn Capital, expects to derive larger earnings from appreciation in the value of securities than from dividends or interest thereon. Brooklyn Capital, will originate and also take part in the underwriting of security issues, thus affording to its stockholders a means of participating indirectly in financial operations, which would not otherwise be available to them as individuals.

In creating Brooklyn Capital, its organizers, who will be active in the management, believe that the securities of well-managed companies in this field offer such favorable prospects for steady enhancement in capital value and earning power as to warrant long and short term investments therein. Consistent growth of Brooklyn is evidenced by the fact that with a population of 2,308,500 against 1,798,513 in 1915, it is second only to Chicago and exceeds Manhattan by 556,500, estimate of July 1, 1928 reported by the Federal Census Bureau. The growth of Long Island is proportionate. Brooklyn has 208 miles of water-front, of which 108 miles are improved; 187 piers accommodating 700 ocean liners; 53 National Banks; 38 Trust Companies; 50 State Banks; 5 Private Banks; 26 Savings Banks. Brooklyn's manufactures total annually over One Billion Dollars Brooklyn leads the world in the importation, refining and distribution of sugar, Brooklyn ranks first in the importation, preparation and distribution of coffee.

MANAGEMENT The Corporation's affairs will be actively managed by the President assisted by a trained staff and will have the benefit of the guidance of the Board of Directors which will include among others: Once again we advise against adopting a "bearish" attitude toward the market. The present quietness eventually will clear up the situation and serve to lay a sound foundation from which a general advance can be reared. Rhoades fe Co. Three stocks in which steady accumulation is noted are Gold Dust, SIX SWEDISH BANKS FAIL Six Swedish public savings banks with total deposits of $11,110,000 have suspended payment, a dispatch from Stockholm says. Pan-American and Curtiss.

Jack son Boesel Co. The public generally are psycho logically In a bearish frame of mind. They are slowly selling stocks and thus reducing Brokers loans and improving the technical position. When it is all over the good stocks are going to be hard to buy but in the meantime there seems no haste in getting In. O.

M. Loeb, E. F. Hut ton Co. A few of the Issues of this kind which appear attractive on reces sions are American Hawaiian Steam- hip, Underwood Elliott Fisher, Standard Oil of Calfornia, Ameri can Locomotive, Commercial Solvents, Continental Baking South ern California Edtson, wooiwortn, Goodyear and Alleghany Corpora Summary of Consolidated Net Income for the Year Ended December 31, 1928 Net Sales $15,133,468.75 Cost of Sales.

v. 7,973,406.46 Gross Profit i $7,160,062.29 Selling and Handling 4,776,636.71 Selling Profit. :.:..77. General and Administrative Expenses 801,071.24 Profit From Operations 7.7. .7.717.7:7.7.

$1,582,354.34 OTHER INCOxME CREDITS (Including profit from sales of securities, $292,950.63) 647,324.37 Gross Income $2,229,678.71 Income Charges 3S9.829.92 Net Income for the Year Before Federal Income Tax. .77 $1,839,848.79 Dividends TaTary. 1928 7.. July, 1928 318,468.00 December, 1928 318,771.40 $955,921.20 tion. Frazier Jelke Co.

A few stocks act as if they were becoming over sold. Renewed pressure fails to force them materially lower and they respond easily to buying. We would mention Chrys ler, Johns-Manvllle, Anaconda. Orvis Bros. Co.

The alcohol stocks as a group Hon. William M. Calder Former United States Senator President and Treasurer, W. M. Calrler Corp.

Director, Lawyers Title and Guaranty Co. Director, Nassau 'National Rank Director, Brooklyn National Lite Insurance Co. Manasseh Miller President, Prudential Savings Bank Presid-nt, National Title Guaranty Company Director, Brooklyn National Life Insurance Co. Director, Franklin Surety Company Chauncey F. Doughty Vice President, Brooklyn Commerce Co.

Vice President, Brooklyn Capital, Inc. UUNTER DELATOUR Director, Brooklyn Commerce Company Secretary, Brooklyn National Life Insurance Co. Treasurer, Brooklyn Capital, Inc. Julius Lehrenkrauss President, J. LehrcnkraU Sons, Bankers Trustee, Fulton Snvinns Bank Former Director, Mechanics Bank Meier Stein brink Chase National Bank, Hamilton Branch Member, Advisory Board and Executive Committee Trustee, Greater New York Savirs Bank Director, Englandcr Spring Bed Co.

Brooklyn National Life Insurance Co. Vice President and Director National Title Guaranty Company Director and Chairman, Board of Counsel Chairman of Board, Brooklyn Capital, Inc. G. Foster Smith President and Director, Nassau National Bank Director, Home Title Insurance Co. Trustee, South Brooklyn Savings Institution Director, Empire Fire Insurance Co.

Director, Cosmopolitan Fire Insurance Co. Director, Brooklyn National Life Insurance Co. Director, Long Inland Safe Deposit Co, James J. Fradkin President and Director. Brooklyn Commerce Co, President, BrottUyn Capital, Inc.

look higher. The situation in this industry has undergone a change for the better and big profits will be made by the various companies this year. The Wall Street Mirror. A constructive sign of considerable importance will be provided should he market, as measured by average Industrial prices, receive support within this three-point range. BROOKLYN STOCKS Quoted by Hanson i Knon, 35 Broadwai BANK AND TRUST COMPANIES.

Dividend. Bid. Asked Bay Parkway National 185 210 Bedford National 210 230 Bensonhurst 150 170 Brooklyn Nat'l Bank 200 210 Brooklyn Trust 24. 1170 1185 Citliena 225 260 Erasmus 160 J80 Flatbush National 210 225 Globe Exchange '6 410 440 Guardaln National 283 303 Kings County 80 3200 3400 Jamaica National 4 350 Lafayette 290 320 Long Island-Astoria 180 230 Manufacturers Trust, 6 292 298 Mldwood Trust 6 333 350 Municipal 16 810 620 Do units 125 130 Nassau National 12 800 830 Peoples National 12 1300 1600 Prospect 173 190 Queensboro 8 340 PIdgcwood 180 220 Rugby 300 330 Richmond Hill 8 1000 1050 Eprtngfleld Cud. Nat.

130 160 Lnlty State 230 243 Woodslde 250 TITLE AND INSURANCE COMPANIES. American Title 3 87 97 Bkln. Fire 11.23 134 140 Bkln. National Life 283 Brooklyn M. G.

4 120 124 Empire Insurance 19 ft 23ft E-npIre Title At Ouar. 155 170 1st Mort Ouai, LLC. 6 113 135 Ouarantted T. to 88 300 330 Home Title 12 285 305 Long Island Vlt 10 135 160 Marshall Mfg 1 11- 14 National Title 7 190 199 Do rts. 3 Prudence pf 7 103 103 Suffolk Title to Ouar.

4 120 130 MISCELLANEOUS. Ansonla Clock 33 Eohack iH. C), 12.30 67 73 Do pf 7 103 108 BHD. Acad, of Music. 9 12 BRln.

Ware, to Storage 9 60 Coney I. At Dkln ti. 70 Eagle house to 8 123 Falcoii coin 30 Oobel 100 Oreat A. to P. Tea Co, 4 343 353 Do pf 7 114 lit Xiitertype 1st pf 8 114 mrs Butler 9 12 Do pf 6 45 52 Light 40c.

36 59 bo 6'; pf 6 103 104 UergenUialer Linotype. 5 104 107 Killer, Shoe pf. 6 95 tiatlonal Licorice 70 Do pf 6 80 84 N. Y. Invest.

1st pf. 6 95 99 Do pf 8 94 0B Do warrant! B'i 10ft Rlgney As Co. pf 1 8 12 Robert Oalr 12 75 34 Eoulbb, E. com 63 Tqulbb pf 8 98 knlon Frr 10 13 Mud extra. lEx-rlghti.

i Ex-dlvldcnd. Should this support level, however, be definitely broken through, the indications would be definitely bearish. J. S. Bache Co.

anil. I alock without par value. $822,040.00. oi wh.ch Ir.lD OOO DO rm. There was some good buying of credit to good-will, trade markv of and a credit to capital aurolua nf SI fH): 11 I 1 i I I- J- InTO rum 1 I 1 lanaui ucucniurc uonua, quo woo, ana tony.ti.

Warner Brothers Pictures below par, but the stock is still in a down trend and we are not yet keen about NOTE: No provision has been rnmle the booki of account or in the above balance iheet for a po'nible nt of approiimnlel.v $17,585.00 on account of Federal income iue for the yean l'i20 to l'J-6, inclusive, nor for Federal income tax for the year ended December 31. 1928. recommending its purchase. Jacques Cohen of Barr Cohen Co Caution must be exercised (we are repeating this for emphasis) and accounts kept In good liquid posi tion so as to take advantage or opportunities as they accrue when this period of deflation and correction Is over. R.

S. Fowler of Wade Bros. Co. With the curtailment of credit, we sea In call attention to the automo bile trade, where recent practice Brooklyn Capital, will receive a net amount of $1,000,000 cash from the issua and sale of 50,000 shares of its capital stock after paying all expenses incidental to the organization, and exclusive of the remaining 50,000 shares option hereinafter mentioned. Ten per cent, of the 50,000 shares to be presently issued will be taken for investment by certain of the organizers or interests affiliated with them, at the same price as that to be paid for the shares now offered and are not included in this offering.

None of the organizers, directors or interests with which they are affiliated will receive any consideration in connection with the organization of the corporation except for organization expenses and commissions paid for the distribution of the stock hereby offered. They, or their nominee, will receive an option entitling them to subscribe to 50,000 shares of authorized, but at present unissued, capital stock not later than February 1st, 1939, at the same price at which this offering is made to the public. PRICE $23 PER SHARE Brooklyn Commerce Company Founded by Brooklyn Bankers and Business Men I SPECIALISTS IN BROOKLYN SECURITIES 215 Montagu Street, Brooklyn, N. Y. Tatopkona TRIand t7tO Al statements made herein, while not guaranteed are believed by us to be accural of encouraging purchases ot cars on CERTIFICATE We have mad.

a genera) audit of the account, of Macfadden Publications, and those ofitasub. companiea for the ye.f ended December 31, 1928, and We Hereby Certify thai in our opinion the foreiomg conaol dated balance sheet and summary of con solidateu net income are correct. HASKINS SELLS. New York. March 26, 1929.

There in count tj preparation a brochurt setting forth the history, financial druciurt, bujineM and prospect of the company. A copy will be mailed gladly upon request. Macfadden Publications Inc. 1926 Broadway (AT Lincoln square) New York installment is now, we understand, meeting with the disapproval of banks. F.

B. Keech Sc Co. With plenty of stock for sale on all strong spots It is difficult to expect anything beyond temporary rallies. J. L.

Knobles of C. H. Van Burcn Co. Aggregate Phone Earnings Up Earnings of 97 telephone compa nies, as reported to the Interstate Commerce CommLvsion for January, compares as Jen. ros I3.7?M?S M3.2S1.IKI4 Operating Income.

14, 7.16.4:4 Sl.HH.OHJ Includes 97 couip.ulea lu both yean..

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About The Brooklyn Daily Eagle Archive

- Pages Available:

- 1,426,564

- Years Available:

- 1841-1963